What's New

Healthcare News, Updates & Tips

Updated September, 2025

Medicare AEP is Coming: Here's What You Need to Know

Medicare’s Annual Enrollment Period (AEP) runs from October 15 through December 7, and it’s the one time each year when you can review, compare, and make changes to your Medicare Advantage and Medicare Part D prescription drug plans. Any changes you make during this period will take effect January 1, 2026. With plan benefits, premiums, and provider networks changing annually, it’s important to take a fresh look to ensure your coverage still meets your health and budget needs.

What Should You Do?

- Review your Annual Notice of Change (ANOC) from your current plan

- Make a list of your providers and medications to confirm they’re covered

- Reach out early to schedule a one-on-one review with our team

Beginning October 1, we can walk through your options and help you choose the plan that’s right for you. Don’t wait until the last minute — contact us today to set up your review appointment so you’ll be ready when AEP officially opens.

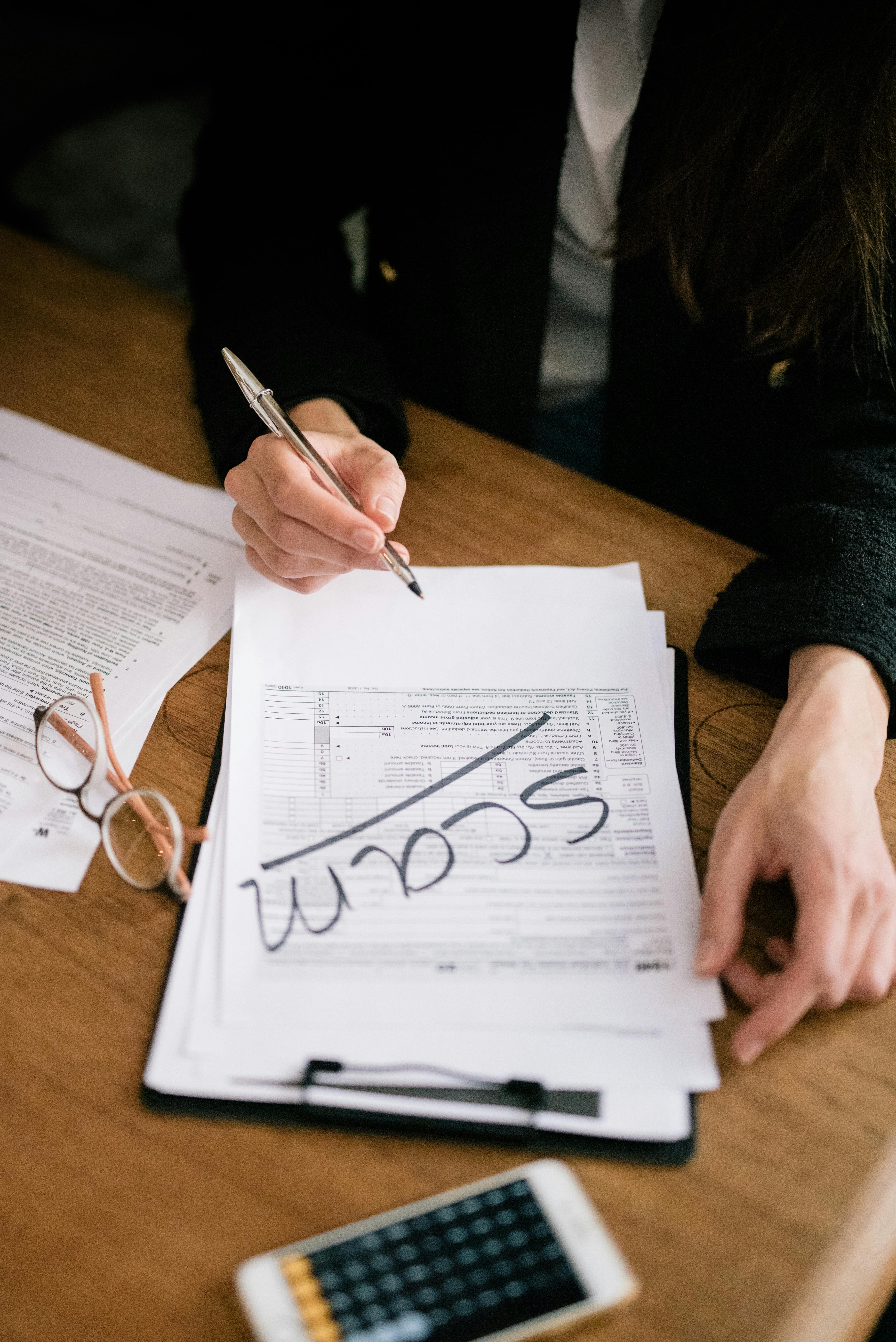

Life Insurance Scams Are Surging in 2025—Here’s How to Stay Safe

Life insurance is more essential than ever, but in 2025 it’s also become a prime target for scammers. With more policies being sold and managed online, criminals are using AI-generated emails, fake websites, and spoofed phone calls to impersonate agents, file fraudulent claims, and steal personal information.

Common schemes include fake policy offers with low premiums and no real coverage, calls from imposters posing as insurers asking for Social Security numbers, and even cases of criminals impersonating beneficiaries to claim death benefits.

Protecting yourself starts with vigilance. Always verify an agent’s license through your state’s insurance department and confirm that your insurer is registered with the NAIC. Be cautious with unsolicited messages, and never click links or share sensitive information without confirming the sender’s legitimacy. If you suspect a scam, report it immediately to your insurer, your state insurance regulator, or the FTC. Life insurance should offer peace of mind—not open the door to fraud.

ACA Overhaul in the Works

On July 3, 2025, lawmakers in Washington passed the “One Big Beautiful Bill Act” (OBBBA) , which includes several changes to the Affordable Care Act (ACA). While the legislation is now official, many of the details are still being shaped through rulemaking, guidance, and state-level decisions. That means real-world impacts may shift as the law is rolled out. Here's a look at what the law includes so far and how it could affect individuals and families in the months ahead.

Key ACA Changes

1. Expiration of Subsidies

Enhanced premium tax credits, expanded under the American Rescue Plan and extended by the Inflation Reduction Act, are set to end in late 2025. Without renewal, premiums may rise — by up to 75% in some states.

The Congressional Budget Office (CBO) estimates around 4.2 million people could lose coverage.

2. Enrollment Policy Changes

The bill proposes adjustments that could affect ACA sign-ups:

- A shorter enrollment window

- Ending automatic re-enrollment (affecting ~11 million people)

- Annual income and eligibility checks

- Revised access rules for certain legal immigrants

The CBO projects these changes could result in 3.1 million more people becoming uninsured.

3. Medicaid Reforms

Proposed changes to Medicaid include:

- Work requirements for some able-bodied adults

- Higher cost-sharing for those above the poverty line

- Tighter eligibility verification

- Reduced federal support for states covering undocumented immigrants

- Limits on funding for certain services, including gender-affirming care

The CBO projects these changes could lead to 7.8 million losing Medicaid coverage.